Mississippi offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Mississippi Government

400 High Street

Jackson, MS 39201

(601) 359-3114

Hours: M-F 8:00am – 5:00pm

Mississippi Power Company

2992 W Beach Blvd

Gulfport, MS 39501

Residential Customer Service

1-800-532-1502

M-F 7:00am – 7:00pm

Business Customer Service

1-877-656-1836

M-F 8:00am – 5:00pm

Mississippi Energy and Natural Resources Division

Mississippi Development Authority

501 North West St.

Jackson, MS 39201

Phone: (601) 359-3449

Toll-Free: (800) 360-3323

Monday – Friday

9:00am – 5:00pm, subject to change

Jackson Weather Bureau

234 Weather Service Dr.

Flowood, MS 39232

(601) 936-2189

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Mississippi Clean Energy

Energy Efficiency

Electric Vehicle Program

Solar Power Guide

Power Outage Map

State Legislature

Mississippi Department of Environmental Quality

515 East Amite Street

Jackson, MS 39201

Monday to Friday

8am-5pm CST

Mailing Address:

P. O. Box 2261

Jackson, MS 39225

Phone: (601) 961-5171

Mississippi Solar Energy Overview

MS residents pay moderately lower monthly electric bills when compared to other states in the U.S.,5 therefore, homeowners in this southern state have been less likely than those in other parts of the country to invest in solar panels, despite all that plentiful southern sunshine.

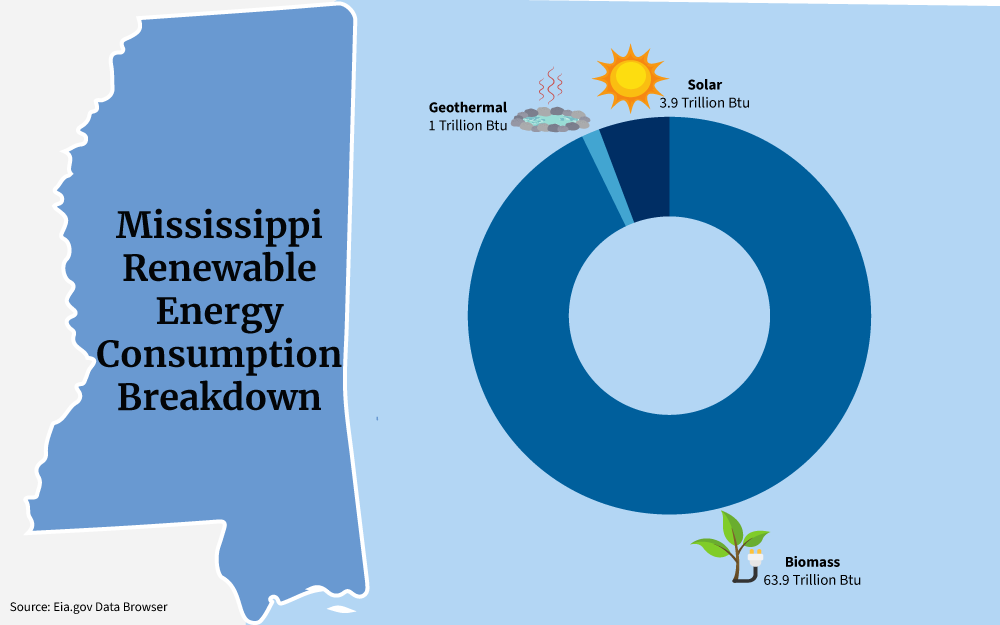

In fact, the vast majority of electricity in the state comes from non-renewable sources like natural gas and coal.13

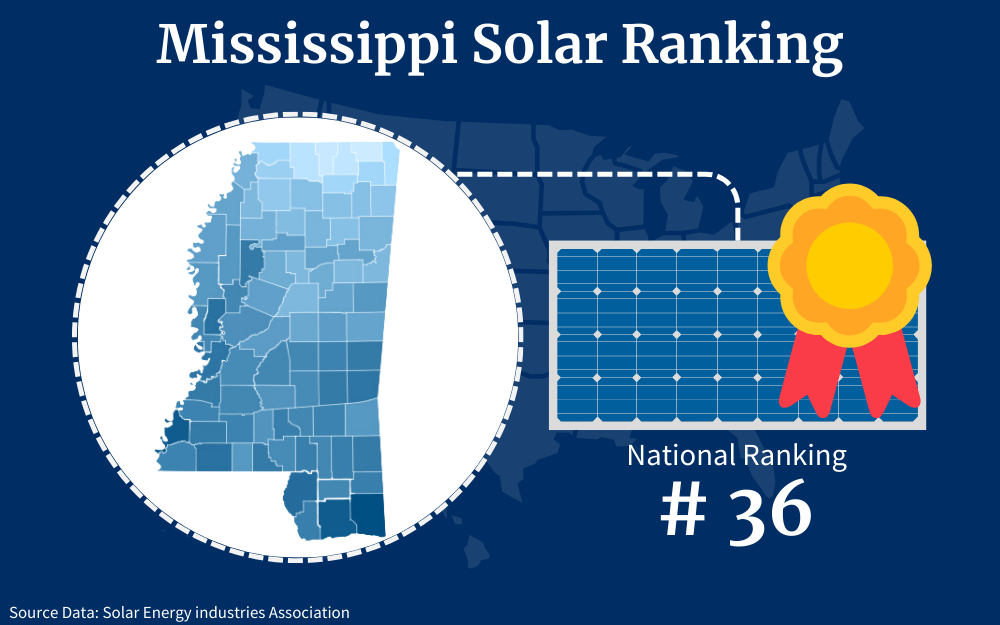

Currently, the state ranks thirty-sixth in solar adoption.

In the long run, without any Mississippi solar incentives to encourage people to change resources this heavy reliance on fossil fuels is expected to contribute to climate change, including sea level rise,8 which can pose big problems for coastal states like Mississippi.

Interested in reducing your emissions impact, lowering your energy costs, and keeping the power flowing even when the grid goes out? This guide explains how you can make a home solar system affordable with tax credits and other solar incentives offered by the state and federal government.

Programs That Mississippi Is Using To Make Solar Panels Affordable to Residents

Many people like the idea of solar energy–who wouldn’t want free electricity–but are put off by the upfront costs of purchasing and installing solar panels for home.

While a home solar power system doesn’t necessarily come cheap, various government incentives can help reduce its cost. These programs are offered to residents to encourage the use of clean energy across the state.

Some of the biggest solar incentives in the U.S. in 2023 come in the form of tax credits, but do you understand how they work?

How Solar Tax Credits Work

All tax credits are designed to reduce your tax liability, or how much tax you owe. They typically offset your tax burden dollar-for-dollar, which means every dollar you receive in the form of a tax credit is a dollar you don’t have to pay to Uncle Sam.

That means if you owe $1,000, but you receive a $1,000 tax credit, you would owe $0 instead. Instead, you can hold onto that money and use it to offset the cost of your new solar panels or to fill other gaps in your budget.

Federal incentives in the U.S. are known as Investment Tax Credits or ITC, and they are available to residents of all 50 states, including Mississippi.

Solar Tax Credit Application Process

If the idea of complex applications and too many forms to complete is keeping you from exploring solar tax credits, don’t worry; federal tax credits are surprisingly simple to get.

There are no special applications or forms to complete beyond the standard federal tax forms and exhibits. Best of all, there is no approval you need to wait for.

You just file your taxes as you normally would, complete the exhibits related to residential solar credit, and go ahead and include the credit in your calculations.

Documents Required for Solar Tax Credit Approval

In addition to the standard federal tax forms and schedules you would fill out regularly, you will need to complete IRS Form 5695 if you are claiming a federal solar panel tax credit.

This simple two-page tax schedule contains questions related to the cost of your new solar system, the technical specifications, like how much power it produces, and other basic information about your home.

Many solar companies will help you with the information you’ll need for this schedule, or you may be able to find it in the installation contract you complete when you purchase your solar system.

Free Solar Panel Options in Mississippi

You may be wondering, “Can I get solar panels free in Mississippi?”

Unfortunately, not at this moment. But while Mississippi doesn’t offer any free solar panel options for homeowners, that doesn’t mean you’re stuck paying the sticker price. Both federal and state incentives can help reduce sticker shock and help make solar a reality for your family.

Even better, there are low-income solar program options that the state offers, aimed at families with moderate earnings, who will benefit the most from solar incentives, and from the resulting reduction in monthly energy costs that come when you switch to solar.

Additional Local Solar Rebates and Renewable Energy Programs in MS

In addition to the federal tax credit, residents in certain areas of Mississippi can register for local solar and renewable energy rebates.

Mississippi Power Residential Energy Efficiency Rebate Program

With these Mississippi solar incentives, customers who make energy efficiency upgrades to their homes can register for a variety of rebates, including:

- Smart Thermostats: $100

- Heat Pumps and HVAC: $200 per ton

- Attic Insulation: 20 cents per square foot

- Water Heaters, Window AC Units, and Energy Star Appliances: Amount varies

- Electric and Hybrid Vehicles and Battery Chargers: $250-$1250

To take advantage of these energy saving programs, visit the MS Power website.

Pearl River Valley Electric Power Association: Residential Energy Efficiency Rebate Program

Much like the Mississippi Power rebates, this utility provider provides rebates for heat pump and AC Unit upgrades, and will also help new homes qualify for enhanced savings by outlining standards for both new construction and older homes.

Federal Residential Solar Energy Credit

The most generous incentive for potential solar shoppers is the Residential Solar Energy Credit offered by the federal government.12 For solar systems installed between 2022 and 2032, homeowners can tax a whopping 30% tax credit to offset the cost of the project.

Best of all, there’s no maximum limit. If your system costs $20,000 for example, you would get a $6,000 tax credit that year, which can go a long way toward making solar affordable.

This federal program runs all the way through 2034, though the credit is reduced to 22% of the cost for solar systems installed between 2032 and 2034.

How Do I Qualify for the Federal Solar Energy Credit?

To qualify for the federal solar energy credit, you need to either pay for your solar panels system upfront or finance it. Leased systems don’t qualify for this program.

You also need to have a new, original installation; that means if you move into a home that already has existing solar panels, you can’t get the tax credit.

The federal credit covers almost all costs associated with installing a new solar system, including:

- Solar/Photovoltaic (PV) panels

- Contractor fees, including permit and inspection costs

- Costs for wiring, inverters, and connectors

- Energy storage devices, like batteries

- Sales tax on solar system purchases

Does Mississippi Have a State Tax Credit for Solar?

As of 2023, Mississippi does not offer a state-level tax credit for solar installations.

Fortunately, residents of the state can enjoy federal incentives when considering installing solar systems in their homes.

And, recent renewable energy funding to the states from the federal government may change that dynamic.

Can I Fill Out Energy Credit Applications Online?

The internet makes it easy for Mississippi homeowners to apply for solar incentives at both the state and federal levels.

Online Application for Federal Solar Energy Tax Credit

The ITC from the federal government for residential solar requires no application form at all. To qualify, homeowners who invest in solar panels in Mississippi and meet all of the requirements for the credit will just wait until tax time.12

In addition to their regular tax forms, they will file Form 5695 to ensure they qualify for the credit.3 This form can be filed online as part of your regular tax filing process; no special forms or applications are required.

Online Application for Mississippi Net Renewal Generation

Both of Mississippi’s public utility companies allow customers to apply for the state’s net metering program, or net renewal generation program, via online forms.

Mississippi Power customers and Entergy customers can apply through the respective companies’ websites.

What Paperwork Do I Need To Qualify for Solar Incentives?

Your utility provider can help you understand what documentation you will need to qualify for net metering incentives.

This documentation may include verification of income, copies of receipts and contracts for solar installation, as well as technical information about the performance and capabilities of your solar system.

Your solar contractor can help you with the details if you have questions when completing net metering applications.

How Can Home Solar Reduce Your Energy Bills?

Beyond the obvious benefit of free energy from the sun, solar panels offer a further reduction in energy costs thanks to a concept called net metering.

What Is Net Metering?

Net metering is an idea that has been around for decades. It means that you get to switch roles with your utility company by selling them the electricity you produce with your solar power panels.

While that may sound complicated, it’s actually surprisingly simple, with excess energy automatically and seamlessly going to the utility provider without any work on your part once the process is in place.

How Does Net Metering Work in Mississippi?

In Mississippi, net metering is officially known as “Net Renewable Generation.” Under this system, any homeowner with a solar system receives a bill credit from their utility company consisting of two parts.

The first is the “avoided cost” of electricity per kWh; that’s how much the utility company would have charged you for that unit of electricity if you didn’t have a solar system, and it’s based on rates set statewide by the Mississippi Public Service Commission.6

The second part is a credit of 2.5 cents per kWh, plus an extra 2 cents per kWh for any homeowners earning less than 250% of the federal poverty line.

In July 2022, the state legislature expanded its Net Renewable Generation program to ensure that half of all funds going to this program would be aimed at low and middle-income families, a status that applies to a staggering half a million homes in Mississippi.11

How Much Can Net Metering Save Me?

Mississippi ranks in the top ten most expensive states in terms of monthly utility bills in the U.S.5 Over time, harnessing the sun for free electricity can significantly cut costs and improve its current solar capacity.

Add in the benefits of the state’s Net Renewable Generation and the effects of federal tax credit and you might be surprised to learn how quickly these systems can pay for themselves.

What’s Involved in Solar Panel Installation in Mississippi?

Ready to take the plunge and invest in a solar system? Understanding average costs and the materials required to make these systems work can help prepare you to make the best possible investment.

How Much Do Solar Panels Cost in Mississippi on Average?

The truth about solar panels is that their prices can be a bit steep for the common homeowner. The average residential solar installation costs about $14,800.10 That’s assuming a typical 5-kilowatt system at a cost of $2.96 per watt, the going average of solar panel in USA. Of course, many different things can affect that cost, including:

- The size of your home: A solar system in a 3,000 SF house is going to cost more on average than one installed in a 1,500 SF home.

- How much energy you want to produce: Solar systems can be designed to replace just a portion of the electricity you use in your home, or can produce all of your power and let you live entirely off the grid. The more electricity you want your system to make, the more it will typically cost

- Your roof: How much of your roof is exposed to the sun? How steep or flat is it? Are there multiple levels or skylights? Do you have trees overhanging your property? All of these factors can affect the cost and performance of your solar system

What Materials Do I Need for a Solar System?

A solar system designed to produce electricity in the home requires more than just a line of panels on your roof; there are a number of other solar products you need for a complete, functioning one.

These panels made up of a bunch of interconnected solar cells, only collect the sunlight. You’ll need mounting brackets to hold them at the right angle, and perhaps even a mounting system that moves to allow the panels to follow the sun throughout the day.

You’ll also need an inverter, which transforms all that collected energy from the sun into AC power, which is what you can use to power the electronics in your home.

Don’t Forget the Battery

The appeal of free, clean solar energy is impossible to overstate, but what happens at night, or when the clouds roll in?

Some buyers might worry that a lack of sun means a pause in solar home power, but thanks to modern storage systems, that isn’t the case at all. Today’s PV solar systems come with batteries designed to store excess energy so it’s available anytime, no matter the weather or time of day.

You can always go the DIY route in installing a PV system for your home. If you have enough knowledge about how these things work, you can just google “how to make a solar cell” and several guides will pop up in the search results to help you in setting your system up.

Solar Energy Estimator (PV Watts Calculator)

Ready to get down to the nitty-gritty details of your new solar system? Read on to learn about sizing and how much electricity you can expect the panels to produce.

How Many Panels Do I Need?

To figure out how many PV solar panels you need, you first need to know how much electricity you use. For this, check your electric bill.

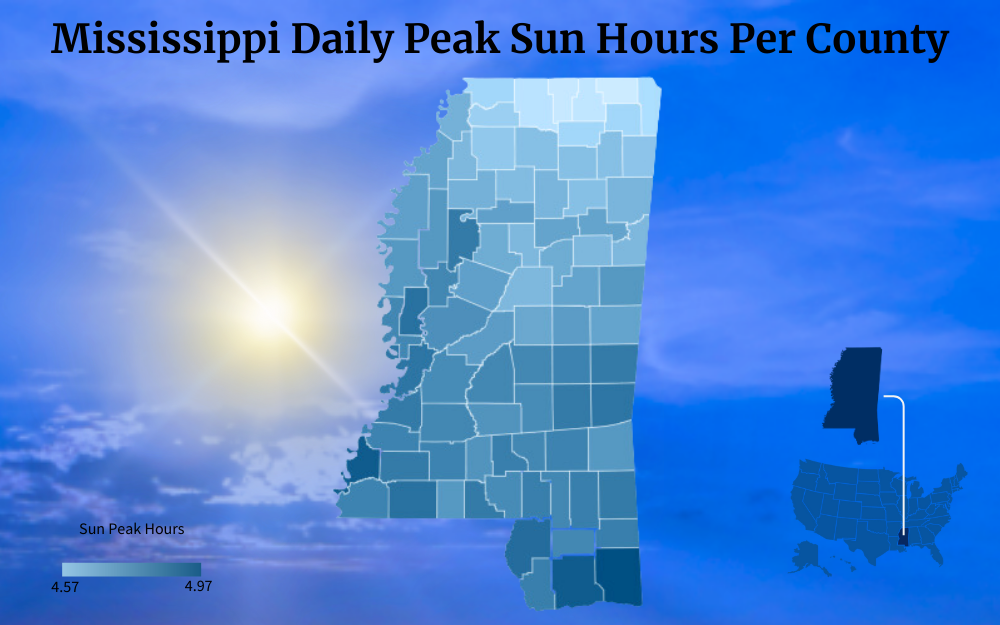

In Mississippi, the average home uses 1,132 kilowatt hours (kWh) per month.5 If you divide this number by 30 days in a month, you’ll get 37.73 kWh per day.

Now divide by the hours of sun your home receives per day. In Mississippi, the average number of hours is around 5.9

If we divide that 37.73 kWh per day by that 5 hours of sun, we determine that we need a system sized at around 7.5 kW. But because solar systems aren’t 100% efficient, experts suggest multiplying that by 1.2 to get an accurate system size of 9 kW.2

Solar panels are rated in watts, with 400 watts being a common size.1 Take your 9 kW, multiply by 1,000 to transform kW to watts, and then divide by 400 watts.

This calculation reveals that the average Mississippi home using 1,132 kWh of electricity per month would need 22.5 panels, rounded up to 23, to completely go off the grid.

A solar panel calculator by address can assist you in figuring this out more quickly.

How Much Energy Can Panels Produce?

The amount of energy your solar system can produce is up to you. As determined above, the average Mississippi home would need 23 panels to produce 1,132 kWh per month, but what if you didn’t need to go completely off-grid?

If you wanted to lower your upfront costs and just reduce your reliance on the grid by half, you could buy just 11 or 12 solar panels. That would provide roughly half the energy for the average home in Mississippi, with the other half coming from utility providers Entergy or Mississippi Power.

Alternatively, you can use a solar output calculator, of which many are available online, to help you determine this more efficiently.

How Much Money Can I Save With Solar?

The amount you save on your electricity bill when investing in a solar system is largely up to you.

If you install a system large enough to power your entire home, your monthly bill will be zero. That means a family paying $125 a month would save $1,500 the first year, $15,000 after ten years, and $30,000 after twenty years,7 which is also the average lifespan of solar panels.

But if you’re wondering exactly how long are solar panels good for, that’s also up to the quality of the system you’ll purchase and your maintenance over the years.

Do Solar Panels Boost Home Value?

In addition to tax credits and monthly energy cost savings, solar systems can boost your budget in another way: by increasing the value of your home by an average of 4.1%.4 That’s an increase of almost $10,000 based on the value of the average home.

Using Photovoltaic Cells in Mississippi for the Solar Grid

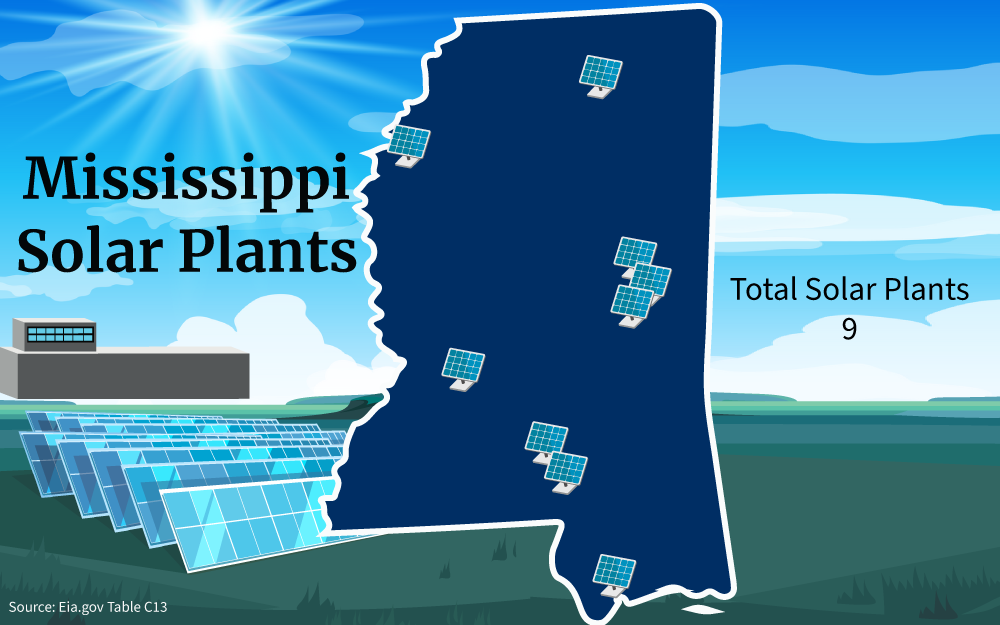

Mississippi residents have plenty of options when it comes to choosing solar suppliers and installers.

Currently, the state has plenty of room to increase its renewable energy consumption amounts.

Best Practices for Installing Solar Panels

While the majority of homes can accommodate some type of solar system, certain best practices apply to all homeowners looking to take advantage of solar energy.

- Plan to install your solar panels in the area of your property that receives the most sun, with minimal shade and few to no obstructions from trees or other items.

- If you think your property might not soak up enough sun to benefit from solar, consider mounting arrays that track the movement of the sun and adjust the angle, tilt, and direction of your panels to maximize the amount of solar energy they can collect each day.

- Think off the roof. While the typical homeowner has panels installed on the roof, this isn’t always the best option. If another spot on your property receives more sun than the roof, say a sunny stretch of the garden, it may be possible to put your panels there instead.

Choosing Solar Panels

Homeowners today have countless options when choosing solar panels. Some key things to look for include watts, solar energy efficiency, and warranty.

Watts measure the amount of power each photovoltaic panel can produce, with higher wattages associated with greater energy output. Efficiency measures how much of the energy collected by each panel is transformed into usable energy, so the closer this number is to 100%, the more efficient the panel is.

Finally, keep an eye on the warranty, and make sure the warranty covers both material and installation defects.

Check Your Roof

One surefire way to waste money is to install brand-new solar panels on a roof that is nearing the end of its life. If you expect to replace your roof in the near future, have this work done in advance of solar panel installation to avoid disrupting the panels later when the roof finally bites the bullet.

Renewable energy solar panels will have no harmful effect on the environment as long as they are cared for properly till their end of life. And that is why the government makes sure to promote accessibility to it to as many people as possible.

Solar energy use continues to grow across the region, backed by both the federal and state governments’ encouragement through different programs and incentives.

And while the state doesn’t have state-wide Mississippi solar incentives and solar tax credits like some other U.S. states, residents of the Magnolia state can still offset the cost of going solar thanks to federal tax credits and net metering programs offered by local utilities.

Frequently Asked Questions About Mississippi Solar Incentives

Are Solar Tax Credits Refundable?

No. If your solar tax credit is more than your tax liability, Uncle Sam won’t refund the difference. The good news is that you can save any excess credit amount for future tax years when your liability may be higher.

Do Mississippi Utility Companies Set Their Net Metering Rates?

No. All net metering rates in Mississippi are set by the state’s Public Service Commission, so you can enjoy identical net metering rates regardless of who your provider is.

Can I Qualify for Solar Tax Credits if I Lease My Solar Panels?

Leasing is a great way to enjoy the benefits of solar without the upfront investment, but unfortunately, you won’t qualify for federal solar tax credits if you lease. This credit is only for those who finance their system or pay for it outright with cash.

References

1Aggarwal, V. (2023, July 1). What is the output of a solar panel? EnergySage. Retrieved September 7, 2023, from <https://news.energysage.com/what-is-the-power-output-of-a-solar-panel/>

2GoGreenSolar.com. (2023). Sizing Solar Systems: A Step-By-Step Walkthrough. GoGreenSolar.com. Retrieved September 7, 2023, from <https://www.gogreensolar.com/pages/sizing-solar-systems>

3Internal Revenue Service. (2023, February 17). About Form 5695, Residential Energy Credits. Internal Revenue Service. Retrieved September 7, 2023, from <https://www.irs.gov/forms-pubs/about-form-5695>

4Mikhitarian, S. (2019, April 16). Homes With Solar Panels Sell for 4.1% More. Zillow. Retrieved September 7, 2023, from <https://www.zillow.com/research/solar-panels-house-sell-more-23798/>

5Mississippi Public Service Commission. (2019). Mississippi Utility Customer Update. Mississippi Public Service Commission. Retrieved September 7, 2023, from <https://www.psc.ms.gov/sites/default/files/2020-02/FromtheDeskOf_WhereDoMSElectricityBillsRank.pdf>

6Mississippi Public Service Commission. (2022, July 12). Mississippi PSC Approves Modified Distributed Generation and Interconnection Rules. Mississippi Public Service Commission. Retrieved September 7, 2023, from <https://www.psc.ms.gov/sites/default/files/2022-07/PRESS%20RELEASE_MPSCDistributedGeneration_1.pdf>

7Office of the Mississippi Attorney General. (2023). A Consumer’s Guide To Solar Power In Mississippi. Mississippi Public Service Commission. Retrieved September 7, 2023, from <https://www.psc.ms.gov/sites/default/files/Documents/SolarPower_MSConsumerGuide-digital-version_0.pdf>

8Runkle, J., Kunkel, K. E., Champion, S. M., Frankson, R., Stewart, B. C., & Nielsen-Gammon, J. (2022). Mississippi State Climate Summary 2022. NOAA State Climate Summaries. Retrieved September 7, 2023, from <https://statesummaries.ncics.org/chapter/ms/>

9Sengupta, M., Xie, Y., Lopez, A., Habte, A., Maclaurin, G., & Shelby, J. (2018). Solar Resource Maps and Data. National Renewable Energy Laboratory. Retrieved September 7, 2023, from <https://www.nrel.gov/gis/solar-resource-maps.html>

10Solar Action Alliance. (2021). Solar Panel Cost: Residential Analysis Breakdown. Solar Action Alliance. Retrieved September 7, 2023, from <https://solaractionalliance.org/residential-solar-panel-cost/>

11Solar Energy Industries Association. (2022, July 13). Mississippi Adopts New Net Metering Rules, Takes Step Toward Equitable Growth of Residential Solar Market. Solar Energy Industries Association. Retrieved September 7, 2023, from <https://www.seia.org/news/mississippi-adopts-new-net-metering-rules-takes-step-toward-equitable-growth-residential-solar>

12U.S. Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office of Energy Efficiency & Renewable Energy. Retrieved September 7, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

13U.S. Energy Information Administration. (2022, September 15). Mississippi Profile State Profile and Energy Estimates. U.S. Energy Information Administration. Retrieved September 7, 2023, from <https://www.eia.gov/state/?sid=MS#tabs-4>

14Screenshot of IRS Website About Form 5695. Internal Revenue Service. Retrieved from <https://www.irs.gov/forms-pubs/about-form-5695>